Stress Relief Supplements Market to Grow USD$ 1,070.27 million by 2033 | Regional Insights, CAGR, Top Ingredients (2026)

Stress Relief Supplements Market Overview | Top Brands, New Launches, and Future Outlook 2033

United States Stress Relief Supplements Industry Forecast 2026-2033 | Adaptogens, L-Theanine & Herbal Growth”

AUSTIN, TX, UNITED STATES, February 19, 2026 /EINPresswire.com/ -- Market Size and Growth (2026-2033)— DataM Intelligence 4Market Research LLP

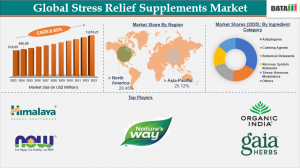

According to DataM Intelligence, the Global Stress Relief Supplements Market was valued at USD 629.93 million in 2025 and is projected to reach USD 1,070.27 million by 2033, growing at a CAGR of 6.85% between 2026 and 2033.

Rising awareness of mental health, increasing stress levels among working professionals, and a growing preference for natural and herbal remedies are driving demand. Consumers are increasingly opting for nutraceuticals, adaptogens, and functional supplements to manage anxiety, improve sleep, and enhance cognitive well-being.

The integration of scientific research, advanced formulation technologies, and personalized supplement solutions is reshaping the landscape, positioning stress relief supplements as a key segment in preventive health and wellness.

Download Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):– https://www.datamintelligence.com/download-sample/stress-relief-supplements-market

New Product Launches by Companies

• Innerbody Labs – Sleep Support & Focus Support (2025–2026): Ashwagandha, L-theanine, saffron (Affron®); clinically dosed for stress reduction, sleep, and daytime calm.

• Needed – Stress Support (Early 2026): Sensoril® ashwagandha, Affron® saffron; supports cortisol balance, relaxation, and emotional well-being.

• Quince – Daily Stress Support (2025): Organic shatavari, ashwagandha, amla, rhodiola; adaptogen blend for mood, focus, energy, and hormonal harmony

• Ritual – Stress Relief BioSeries™ (Feb 2026): Suntheanine® L-theanine, Shoden® ashwagandha, Affron® saffron; non-drowsy 3-in-1 cortisol and mood support.

• Yu Sleep – Plant-Based Sleep & Stress Support (2025): Magnesium bisglycinate, L-theanine; sleep aid with stress relief for daily wellness.

• Moon Juice – SuperYou Stress Formula (Ongoing 2026): Four adaptogens (Ayurvedic/TCM); combats emotional, mental, and hormonal stress with high customer ratings.

• Thorne – Stress Balance (2025): Adaptogens, herbs, vitamins, Siberian ginseng; supports HPA axis, energy, and stamina (not for pregnancy).

Trends:

1. Adaptogen-heavy formulas (ashwagandha, saffron, rhodiola) dominate, with clinically dosed, traceable sourcing.

2. Extended-release tech (e.g., Ritual) and night/day stacks (Innerbody) for all-day coverage.

3. Clean/organic focus (Quince, Moon Juice); market growth tied to cortisol/mood claims.

Top Ingredients in New Stress Relief Supplements (2026):

✅ Ashwagandha: Leading adaptogen; lowers cortisol 20–30% and eases anxiety; in 60%+ of 2026 formulas (Sensoril®, KSM-66®, 125–600 mg/day).

✅ L-Theanine: Promotes calm focus without drowsiness; often paired with caffeine; found in Suntheanine® (100–200 mg).

✅ Saffron: Supports serotonin and dopamine for rapid mood lift; clinically dosed with Affron® (28 mg).

✅ Rhodiola Rosea: Combats fatigue and enhances resilience; standardized 3% rosavins / 1% salidrosides (200–600 mg).

✅ Magnesium Glycinate: Supports serotonin regulation and muscle relaxation; high bioavailability (200–400 mg).

✅ Shatavari / Amla: Provides hormonal balance and antioxidants; increasingly used in organic blends (100–300 mg).

Trends: Extended-release (e.g., Ritual BioSeries™) and stacks (night: ashwagandha/saffron; day: rhodiola/L-theanine)

1. Regulatory Challenges for Launching Stress Relief Supplements

Stress supplements face structure/function claim limits (no disease cures) and evolving rules:

1. FDA/FTC (U.S.): Pre-approval not required (DSHEA), but adulteration/misbranding risks high. Claims like "reduces stress" OK; "treats anxiety" banned. Post-market surveillance via warnings (e.g., ashwagandha thyroid claims).

2. EU Novel Foods: Non-traditional extracts (e.g., high-dose saffron) need authorization; ashwagandha root banned in Denmark (2024).

3. Global: Heavy metals/pesticides testing mandatory; Prop 65 (CA) strict on lead. Clinical dosing claims require human trials.

4. Challenges: Supply chain purity (e.g., adulterated ashwagandha), influencer marketing scrutiny, CBD bans in some regions. Third-party testing (NSF/USP) essential for credibility.

Best-Selling Stress Relief Supplement Brands (2026)

Top sellers blend science-backed ingredients with clean labels; ashwagandha/L-theanine dominance drives sales.

1. Needed – Stress Support: Sensoril® ashwagandha + Affron® saffron; high demand with waitlist, focused on cortisol balance.

2. Ritual – Stress Relief BioSeries™: 3-in-1 timed-release (L-theanine/ashwagandha); subscription-based wellness.

3. Innerbody Labs – Sleep & Focus Support: Multi-blend formula with ashwagandha, L-theanine, and saffron; top-rated 2026 launch.

4. Moon Juice – SuperYou: Four adaptogens; 4.8-star reviews and traceable ingredient sourcing.

5. Quince – Daily Stress Support: Organic shatavari and ashwagandha; affordable wellness at $25/month.

6. Thorne – Stress Balance: Clinical-grade adaptogens; trusted by health professionals for HPA axis support.

Sales Drivers: E-commerce (Amazon, DTC), clinical dosing, non-drowsy claims. Market: Rapid growth via mental health trends.

Growth Drivers

✦ Global prevalence of stress-related disorders surged to over 450 million cases in 2024, fueling demand for preventive supplements.

✦ The herbal and natural supplement segment accounted for 62% of 2024 sales, projected to grow as consumers prefer clean-label, plant-based solutions.

✦ E-commerce sales of stress relief supplements jumped 35% YoY in 2024, driven by subscription-based delivery and D2C platforms.

✦ Increasing workplace stress, long working hours, and urban lifestyle pressures have prompted corporates to include stress management supplements in employee wellness programs.

✦ Scientific validation and clinical trials demonstrating the efficacy of adaptogens such as ashwagandha, rhodiola, and L-theanine are strengthening consumer trust.

Market Segmentation Analysis

By ingredient category, adaptogens are expected to dominate the stress relief supplements market, capturing a notable share of approximately 28% in 2025.

By Form:

Capsules & Tablets: 55% share, fastest growth due to convenience and precise dosing.

Powders & Drinks: 25%, fueled by functional beverages and energy blends.

Gummies & Lozenges: 15%, popular with millennials and Gen Z.

Others: 5%, including sprays and sublingual solutions.

By Ingredient Category:

Adaptogens: Leading segment, ~28% share in 2025, for stress resilience.

Calming Agents: Growing for relaxation and anxiety management.

Botanical Relaxants: Rising popularity in herbal wellness formulations.

Nervous System Nutrients: Supports brain and nerve health.

Stress Hormone Modulators: Targets cortisol and hormonal balance.

Others: Specialty blends and emerging ingredients.

By Source:

Organic: Increasingly preferred for clean-label wellness.

Conventional: Stable segment with wide availability.

By Distribution Channel:

E-commerce & Online Retail: 42%, fastest-growing with subscription models.

Pharmacies & Drugstores: 30%, trusted and accessible.

Health & Wellness Stores: 18%, niche focus on herbal and natural.

Others: 10%, including supermarkets and specialty retail.

By End-User:

Children: Growing segment with kid-friendly formulations.

Adults (18–59 years): Largest consumer base for daily stress management.

Elderly (60+ years): Increasing demand for relaxation and cognitive support.

Request for Customized Sample Report as per Your Business Requirement:- https://www.datamintelligence.com/customize/stress-relief-supplements-market

Regional Insights

North America

2024 market: USD 1.12B → 2032 projection: USD 3.8B

High adoption of nutraceuticals and workplace wellness programs in the US & Canada.

Corporate wellness initiatives and insurance-backed wellness programs are fueling growth.

Europe

2024 market: USD 890M → 2032 projection: USD 2.78B

Rising consumer preference for herbal and organic supplements in Germany, France, and the UK.

EU regulations on health claims are promoting clinically validated products.

Asia-Pacific

Asia-Pacific emerged as the fastest-growing region in the stress relief supplements market, accounting for 25.12% of the market share in 2025.

Growth driven by traditional herbal remedies in China, Japan, and India.

E-commerce penetration and rising awareness of mental health in urban populations.

Latin America & Middle East & Africa

Combined 2024 market: USD 408M → 2032 projection: USD 1.1B

Rising stress levels among working professionals and growing health consciousness driving demand.

Competitive Landscape

The stress relief supplements market is moderately fragmented, with global nutraceutical giants, herbal specialists, and D2C startups competing on efficacy, product transparency, and brand trust.

Key Players:

Herbal & Nutraceutical Leaders:

✅ Himalaya Drug Company: Trusted herbal formulations with global reach.

✅ NOW Foods: Extensive range of natural and functional supplements.

✅ Nature’s Way: Leading provider of herbal wellness products.

✅ GNC Holdings, Inc.: Major player in vitamins, minerals, and nutraceuticals.

✅ Nature’s Bounty: Popular for clinically backed wellness supplements.

✅ Solgar Inc.: Premium supplements with a focus on quality and science.

✅ Herbalife Nutrition Ltd.: Global wellness network with nutritional products.

✅ Nutraceutical International Corporation: Specialty nutraceutical manufacturer.

✅ Organic India: Focused on organic, Ayurvedic-based wellness solutions.

✅ Functional & Adaptogen Specialists:

✅ Gaia Herbs: Herbal adaptogens and plant-based stress relief solutions.

✅ NutraScience Labs: Custom adaptogen formulations and wellness products.

✅ Pure Encapsulations: High-quality supplements targeting stress and cognitive support.

D2C & Startups:

1. CalmWell: Personalized stress relief supplements via direct-to-consumer model.

2. MoodBoost: Innovative nutraceuticals for mood and mental wellness.

3. NutriZen: Subscription-based adaptogen and stress support kits.

Key Highlights:

✔ GNC Holdings, Inc.: Expanded its adaptogen-based stress supplement range with clinically validated ashwagandha blends in 2025.

✔ NOW Foods: Launched stress and sleep combo capsules targeting millennials (March 2025).

✔ Himalaya Drug Company: Partnered with wellness clinics in India to integrate stress relief supplements into therapeutic programs (Jan 2025).

✔ Organic India: Rolled out personalized herbal adaptogen packs for urban professionals to manage daily stress (Feb 2025).

✔ Gaia Herbs: Introduced a plant-based stress and mood support line backed by clinical studies (April 2025).

Buy Now & Unlock 360° Market Intelligence:- https://www.datamintelligence.com/buy-now-page?report=stress-relief-supplements-market

Market Outlook & Opportunities

⇥ Global stress relief supplements are projected to exceed USD 9.87B by 2032, driven by natural and functional product innovations.

⇥ Personalized supplement formulations and AI-driven wellness apps expected to unlock additional USD 1.2B value by 2032.

⇥ Integration with corporate wellness programs and telehealth platforms to accelerate adoption.

Expansion in Asia-Pacific and emerging markets presents high-growth opportunities due to urbanization and digital retail adoption.

Conclusion

The Global Stress Relief Supplements Market is transitioning from traditional herbal remedies to scientifically validated, functional nutraceutical solutions., these products are redefining how individuals manage stress, sleep, and mental wellness.

Supported by corporate wellness programs, e-commerce penetration, and functional supplement innovations, stress relief supplements are poised to become an essential element of preventive health strategies worldwide.

Related Reports

Men’s Vitality Supplements Market (2026-2033)

Mood Ingredients Market (2026-2033)

Sai Kiran

DataM Intelligence 4market Research LLP

+1 877-441-4866

sai.k@datamintelligence.com

Visit us on social media:

LinkedIn

YouTube

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.